.png?width=1187&height=668&name=preview%20livre%20blanc%20-%20landing%20page%20(3).png)

Checklist: Structuring & Monitoring Sustainable Bank Financing (2025)

Download the free essential guide to structuring your sustainable finance projects in full compliance.

Who is this checklist for?

This checklist is aimed at banks and financial institutions wishing to structure their sustainable finance projects.

It is designed for credit, compliance, CSR, strategy or risk teams involved in implementing green finance.

Why download it?

Because it has become essential to :

✅ Align your financing with regulatory requirements (CSRD, SFDR, taxonomy...).

✅ Implement clear ESG governance.

✅ Save time with a ready-to-use operational structure.

What the checklist contains

🔑 7 key steps: governance, project selection, ESG analysis, structuring, monitoring, reporting, innovation.

🎁 Bonus: an ESG mini-glossary (Green Loan, ESG KPI, CSRD, etc.).

Fill in the form and receive your free copy:

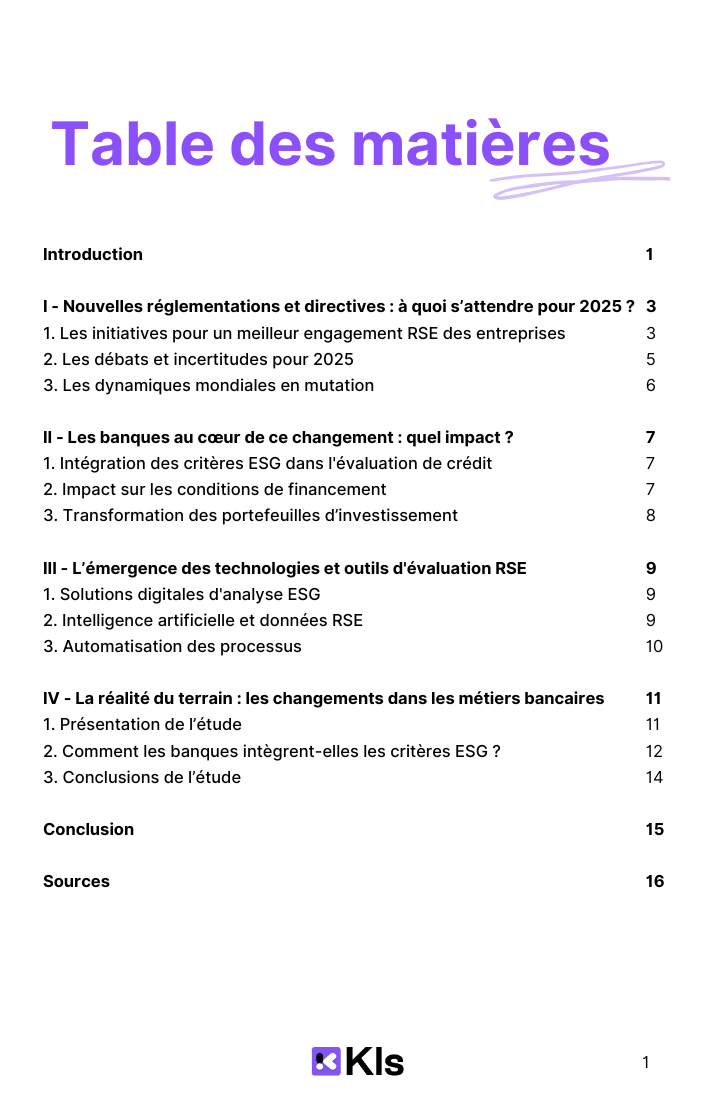

Contents of this white paper

.png?width=1187&height=668&name=preview%20livre%20blanc%20-%20landing%20page%20(3).png)

Frequently asked questions

Why should I read this white paper?

This white paper provides essential information on the new rules of sustainable finance that directly affect corporate banks.

What new regulations are being addressed?

We explore regulations such as the CSRD and CS3D directives, and their impact on banking practices.

Is this white paper right for my business?

If you work in the banking or financial sector, particularly in corporate finance, this white paper is for you.

How can this white paper help me with my banking strategy?

By understanding the trends and challenges of sustainable finance, you'll be better prepared to adapt your investment and financing strategies.

Does it cost anything to download the white paper?

No, this white paper is completely free to download.