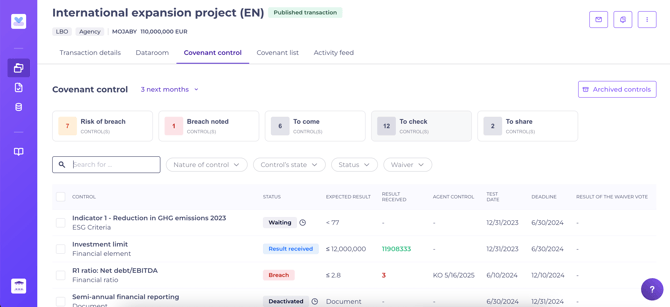

Create and monitor ESG criteria with the Debt Tracking app

Learn how to integrate ESG criteria into your Kls Desk's transactions.

ContextESG criteria (Environmental, Social and Governance) are used to assess how far sustainable development and long-term concerns are incorporated into the strategy of the borrower being financed. These criteria are non-financial in nature and are included in the credit agreement as a standard covenant, to be checked by the operation manager (or an ESG coordinator). Most often, these “ESG covenants” are indexed to a specific target and are structured as a value to be met (percentage, ratio, quantity). The introduction of these new criteria introduces additional aspects to be monitored in each transaction; an important consideration for the teams involved. |

What to expect from this feature ?By using Kls to monitor ESG KPIs, you can:

|

Setting ESG criteria in Kls:

Once your transaction has been created in Kls, navigate to the “Covenant list” tab to set the relevant control indicators.

Creating an ESG criterion follows the same process as creating a standard covenant or an Agent Action.

Select the “ESG Criteria” type of covenant - this allows you to easily identify this category - and complete the fields with the contract information and control conditions.

![[DT] - Cadre contractuel ESG (EN)](https://www.kls-desk.com/hs-fs/hubfs/%5BDT%5D%20-%20Cadre%20contractuel%20ESG%20(EN).png?width=670&height=329&name=%5BDT%5D%20-%20Cadre%20contractuel%20ESG%20(EN).png)

You may use the control value to set a numerical measurement of any type, for example:

- Tonnes of Co2

- Number of electric vehicles

- Percentage of recycled material

- Etc.

You define the KPI's meaning in the “Covenant description” field, which is also visible to your client.

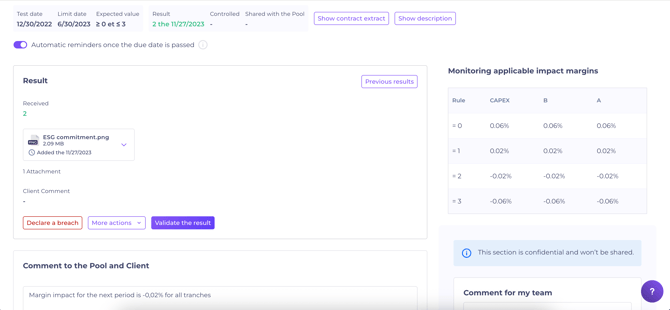

Configuring Margin Impact

When setting the impact on margin, you have two options:

1. Margin impact is linked to the number of ESG KPIs achieved

- In this case, do not enter the margin impact at the level of each KPI.

- Instead, create an additional covenant, for example, called “ESG Criteria Achievement Control – Entered by Agent”.

This approach enables you to adjust the margin based on the number of ESG criteria met.

For example: if each indicator is considered independently and affects the margin by +0.02% or -0.02% if it is met or not, you may have these scenarios:

-

- All 3 indicators met: - 0.06% on margin

- 2 out of 3 indicators met: - 0.02% on margin (-0.02 – 0.02 + 0.02)

- 1 out of 3 indicators met: + 0.02% margin (-0.02 + 0.02 + 0.02)

- None of the indicators met: + 0.06% on margin

Once all KPIs results have been collected for the transaction, you can then complete this final covenant and apply the new, appropriate margin adjustment.

2. Margin impact is set independently for each ESG KPI

In some agreements, ESG criteria vary in importance, and should not be weighted equally.

In this scenario, set the margin impact for each KPI to reflect each criterion’s proportional influence.

If needed, you may also set up an additional notification to summarise results and communicate the final overall margin rate.

Summary

With Kls, you make the monitoring and control of ESG criteria straightforward, whether your transactions involve syndicated loans, impact lending, or any financial transaction with ESG KPIs.

Leverage the Kls tracking tool to plan reminders for ESG trajectory reviews, and so manage these with your client more efficiently.

Finally, our data export module enables you to populate all your internal and external reporting with data from your various controls, reflecting the completion status of each KPI defined.