How to set up covenants in the Debt Tracking app?

In this article, you will find our advice on how to create and set up covenants in your transactions.

Content

DefinitionsContractual covenant: A borrower covenant defined within the contract. In Debt Tracking, the list of contractual covenants is entered by the manager in the "Covenant List" tab. Covenant control: The operational application of the Covenant list. Depending on its frequency, a covenant may be transformed into one or more covenant controls. All covenant controls are visible in the relevant. |

1. Introduction

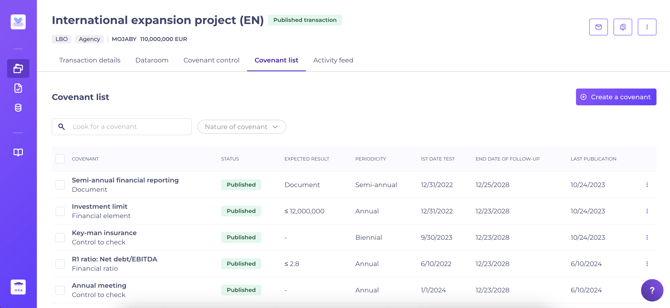

To begin, navigate to Debt Tracking > Operations > Transaction Manager > select desired transaction > Covenant list.

Do you lack access to Debt Tracking? Please contact your manager or a colleague with the “Team Leader” role to request rights for Debt Tracking creation.

Covenant parameters are configured by the operation manager within the covenant list tab of your Debt Tracking transaction. Please ensure the transaction foundation has been created before setting up covenants. See page on how to create a transaction.

The covenant list tab allows you to :

- Centralise contractual events to be monitored: the operation manager digitises all events to be tracked, regardless of their nature, which may include:

- Financial covenants

- ESG KPIs

- Controls to be carried out

- Negative undertakings

- Confidential reminders

- Any other covenant defined by contract

- Automate reminder notifications by defining control periods. Concretely, publishing covenants will automatically activate reminder notifications to be received by Borrower contacts and the management team.

Notifications can be configured at any stage by the operation manager. See the page on setting up automatic notifications.

Each party may retrieve at any time the current list of covenants entered by the operation manager and outstanding from the customer in their Debt Tracking dashboard.

2. The different types of covenants

During set-up, the operation manager defines the control, type which determines its behaviour and expectations:

- Document: requires the Borrower to upload one or more supporting documents when providing the response. Example: company accounts, annual reports, budgets, etc.

- Financial element/Ratio/ESG criteria: the borrower must enter a numeric or qualitative value to respond to the covenant; supporting documents can optionally be attached to support this figure.

- Control to check : requires no action from the borrower. This is mainly used by the lead agent to monitor “to do” or “not to do” covenants where no particular value or supporting evidence is needed.

- Agent action: the only type hidden from other stakeholders. This enables the transaction management team to create internal reminders for the transaction. Like other covenants, agent actions automatically activate reminders for the manager. Example: annual commission reminder.

💡 For “ESG Criteria” covenants, you can enter :

- A category (Environmental, Social, Governance or a custom entry)

- A tailored sub-category

3. How to set up a covenant

Within the Covenant list tab, select “Create covenant”.

The covenant creation page is divided into two sections:

- Covenant details: here, you may paste the relevant contract clauses. The description field lets you set expectations (all these fields are visible to stakeholders).

- Control periodicity:

- First test date. The date from which the element will first be tested.

- Response delay. The period (in days or months) the Borrower has to respond to the covenant.

- Periodicity. Sets how often the control should repeat.

- End date. When monitoring of the element ceases.

Note that the first test date plus response delay defines the deadline for a given covenant check.

For a “document/check to be carried out” or Agent Action, only the above fields need to be completed. For covenants involving a financial element/ratio or ESG criteria, you must also set:

- Expected values. These may remain static for the life of the loan or change annually.

- Margin grid. Where relevant, you can define a margin grid tied to the controlled value.

💡 Once your covenant is entered, click “Create covenant”, then on “Publish the covenant”. When a covenant is published, the platform automatically schedules and generates all future associated controls, which will then appear in the Covenant control tab.

The transaction must be published before any covenant can be published. Publishing the transaction does NOT automatically publish its covenant list—this must be done separately, allowing you to prepare for closing. Until published, the covenant remains invisible to both borrowers and lenders, and related controls or notifications will not activate.

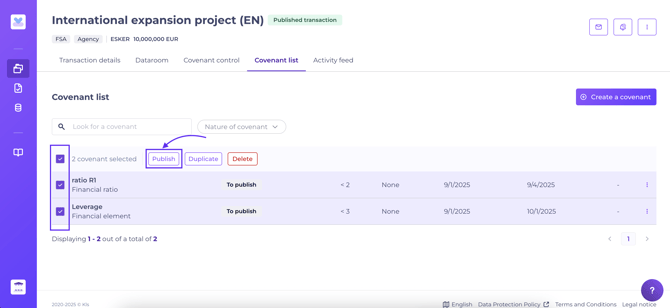

💡You may publish covenants individually or in bulk:

Example - Documentary covenant: to enter a “semi-annual financial reporting” covenant, specify that the borrower must provide financial reporting annually from 31/12/2022 to the contract’s end on 25/12/2028. Each year, the borrower will have until 30/06 to provide these documents.

Example - Ratio: “R1 ratio”:

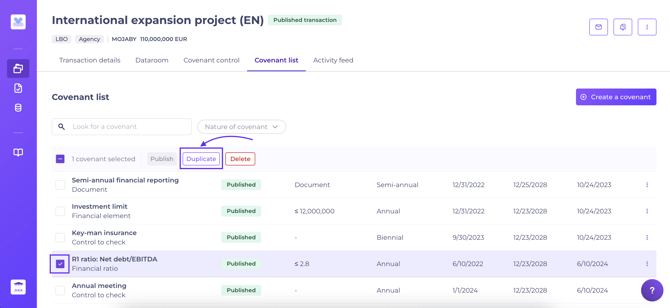

4. Duplicating a covenant

Once a covenant has been created, it can be duplicated.

This feature enables the Credit Officer to quickly recreate covenants which may only differ in a few settings (such as test dates) within the same transaction.

To duplicate a covenant, simply select the covenant(s) concerned, and a “Duplicate” button will appear in the top banner of the table.

To duplicate, simply select the relevant covenant(s). A “Duplicate” button will then appear at the top of the table.

Once duplicated, the covenant(s) will appear in the table as “Covenant wording (Copy)” and with the status “To be published”. These may then be edited and published as new covenants.

Please note:

- All covenant details are copied, and can be edited prior to publication.

- If a covenant has multiple versions, only the latest is duplicated.

- Duplication is limited to the same transaction; it is not possible to duplicate covenants to the list of another transaction.

5. Automatic notifications

When a covenant is created and published, the associated controls are instantly generated in the Covenant control tab.

Automatic notifications will be sent to the Borrower and operation management team at D-30, D-15, D-7 and D-1 before the "Date of the first test". If no response is given by the due date, reminders are sent every 15 days. Notifications will automatically cease when a response is received.

The operation manager can adjust notification settings at any time.

What notifications are sent to my stakeholders?How to set up automatic notifications?