How to manage covenant control in the Kls Desk Debt Tracking app?

In this article, you will find all our tips for managing covenant control on a day-to-day basis.

Content

DefinitionsCovenant: A Borrower's covenant as defined in the contract. In Debt Tracking, the covenant is entered by the operation manager in the covenant list tab. Covenant control: The operational application of the covenant list. Depending on its recurrence, a covenant may take the form of one or more covenant controls. All covenant controls are displayed in the tab of the same name. |

1. How the covenant control tab works

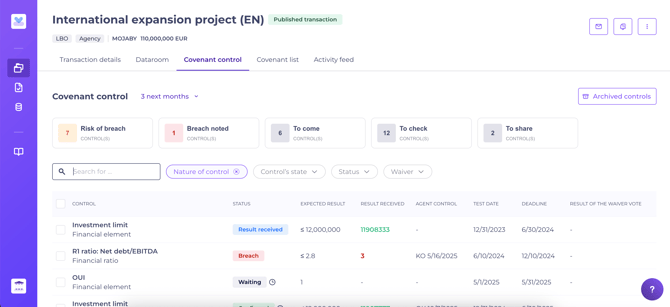

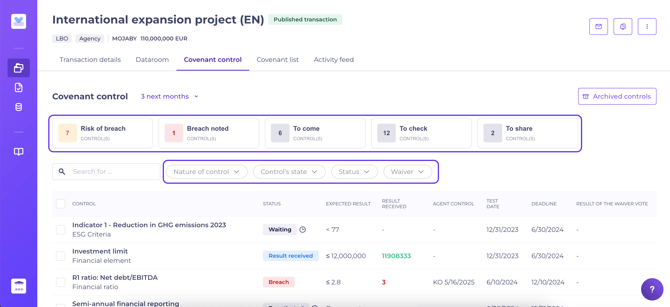

To begin, navigate to Debt Tracking > Operations (Transaction Manager view) > select the relevant transaction > Covenant control.

Do you lack access to Debt Tracking? Please contact your manager or a colleague with the “Team Leader” role to request authorisation for Debt Tracking creation.

The Debt Tracking tab acts as a dashboard of all current and upcoming controls, as well as a space for those that have already been checked.

Each control is created automatically once a covenant is published, based on the information entered in the covenant list tab.

For each control listed, you will find :

- The covenant's wording

- Status:

- Waiting: the covenant's test date has passed, the Borrower may now provide a response.

- Waiting (with clock): the covenant deadline has passed.

- Coming: this covenant is not yet due; the Borrower will be required to respond at a later date.

- Result received: the Borrower has responded to the covenant (or the operation manager has responded on behalf of the customer).

- Validated: the operation management team has validated the covenant.

- Result KO: the value entered does not meet requirements (e.g., a ratio must be < 3 but the submitted value is 3.5; system records as KO). You may validate the result regardless or record a breach.

- Non conform: you (or a member of your team) have marked the result non-compliant. The Borrower may now resubmit a response.

- Breach noted: a breach of covenant has been recorded. A waiver may be drafted subsequently, even after the breach has been communicated to the lenders.

- Expected result: this may be a document or a value, depending on the nature of the covenant.

- Result received: if a result has been entered, “document” or “value X” is shown

- Control date: this date appears only once you have checked the covenant.

- Test date and covenant deadline.

- The result of the waiver vote.

All controls on a transaction are visible to the management team and Borrower contacts.

Lenders only have access to controls where the result has been shared (either validated or marked as breach).

Within this tab, you may use available filters:

Click a filter to apply; click again to return to the default view.

To manage and monitor the controls on your transaction, you must first have created and published the associated covenants. How to set up covenants

💡 Each transaction includes a dedicated covenant control tab. To review all controls across your portfolio, visit the Control monitoring page. This is also the default home page for operation managers.

2. Reply to a covenant

Either the Borrower or the operation manager may respond to a covenant control.

To guide your clients in responding to covenants within Debt Tracking, refer them to How do I use Kls Desk's Debt Tracking app as a Borrower or Issuer?

When a Borrower responds to a covenant, the operation manager contacts receive an automatic notification containing a link to the covenant in question. You can then check it before sharing it with lenders. See checking a covenant.

If, as the operation manager, you wish to reply in the Borrower's place, go to the desired control and click “Respond instead of the Client”:

Then upload the required files and/or enter the expected value before validating. The status of the control will update to “Result received” or, if the value is unsatisfactory, “Result KO”.

You may also add a note for your team (visible only to operation management) and a comment for the Pool and the Client.

All entries are recorded in the control record and can be updated at any time.

By clicking “Show contract extract” or "Show description" buttons, you will display a side second screen with the details written in the Covenant description.

3. Checking a covenant

To validate a covenant, a response must have been registered; the status will display “Result received” or “Result KO”.

You may download any files submitted with the response.

The following actions are possible:

- Validate result

- Declare a breach.

- Click “More actions” to :

- Modify input: add and/or remove documents.

- Declare the result non-compliant: the Borrower may respond again. They will receive an email notification containing a direct link to the covenant.

- Deactivate the control: the control will not be monitored (e.g., for covenant holiday).

- Delete the response from the control: the check status returns to “Waiting” and all information (values, documents, client comments) is deleted.

- Save documents in the dataroom: this allows lenders to access relevant information without checking each individual covenant validation.

- Share the result with lenders, the covenant must be either validated or marked as “Breach noted”

Click the “Share with lenders” button, or “Archive control” for bilateral transactions. The check status will automatically switch to “Archived” and will appear in the archived checks section of the transaction Covenant control tab. All data is recorded for each control.

If a breach is declared, you may record a waiver decision:

💡 To avoid missing a waiver decision after sharing the result with the pool, set up an Agent Action titled “Reminder to enter waiver decision”.

4. Save documents in the dataroom

You can easily duplicate files from the Covenant control to the Dataroom :

Files may be downloaded and then copied to the dataroom folders at any time; whether before or after a result has been validated.

For further details, please refer to: How does the Debt Tracking dataroom work ?

5. Covenant control notifications

Covenant control events, such as reminders or user actions, trigger automatic notifications. You may consult what notifications are sent to my stakeholders.

You can set automatic notifications at any time; for example, lender notifications may be disabled as required. See the page on how to set up automatic notifications.

You can also send instant, personalised notifications to your clients and/or lenders. For details, see the page on personalised notifications.