Debt Tracking features

In this article, you'll find a macro view of the various features available in the Debt Tracking app.

Content

Vocabulary

|

Introduction to Debt Tracking

Debt Tracking is a dedicated management solution for all types of financing operations requiring control and traceability. Whether managed by an individual or a team, Debt Tracking assists with the monitoring, control, sharing, and establishing traceability for your financing processes.

Using Debt Tracking, users can track a broad range of operations, including but not limited to:

- Multi-lender financing (syndicated loans, investor groups, etc.)

- Single-lender financing (bilateral facilities, impact or ESG loans, etc.)

- Real estate financing (including Net Zero Carbone)

- Monitoring participation in transactions where you act solely as a participant

Upon creation of an transaction, all the stakeholders may be invited to take part, whether they are internal or external to your company.

A collaborative workspace is then made available for the operation manager and their team, enabling the centralisation of all the information required for the effective execution and monitoring of your mandates.

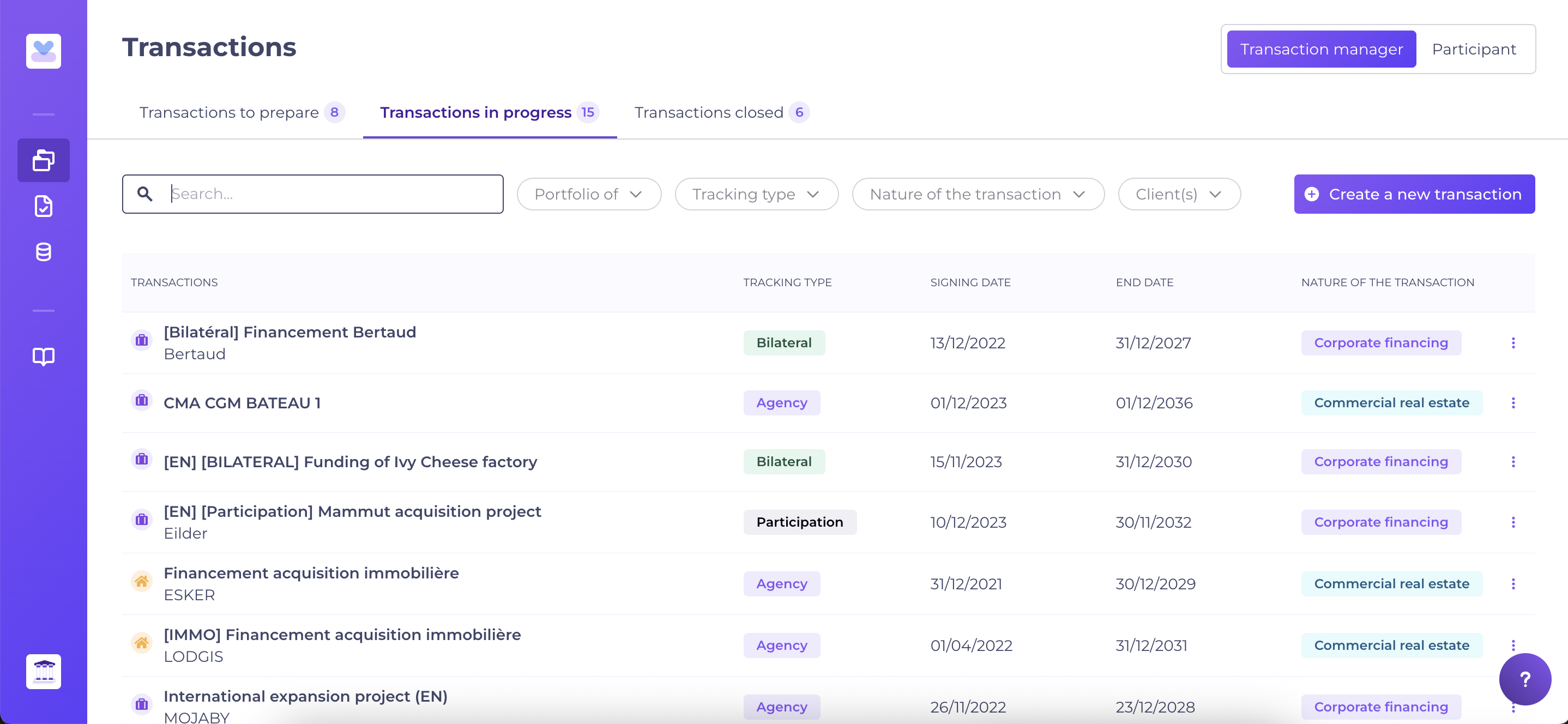

Every transaction created corresponds to an individual entry within Debt Tracking. Users may manage multiple transactions in parallel, with options to filter views by portfolio or by operational status (preparation, active, closed).

Communication with operation stakeholders:

To alleviate mental workload and automate or facilitate recurring tasks for operation managers, a set of actions triggers notifications to the relevant contacts, alerting them to newly available information.

Notification preferences can be managed for each transaction individually. For further details, refer to: What notifications are sent to my stakeholders?

Every transaction within Debt Track is structured into five tabs to streamline the manager's workflow.

The following is an overview of the features provided.

Tab 1: Transaction details

The "Transaction details" tab serves as the home page for each transaction, situating the operation in it appropriate context by displaying stakeholders and financing structure.

Information is organised in blocks (e.g., Clients linked to the risk group, tranches, pool, sub-pool) for clarity.

Key objectives:

- Record essential information, including each lender's allocations and specifications for each financing tranches.

- Manage access for every lender and borrower contact associated with the transaction.

The manager has the option to add contacts for free access to the transaction, whether they are an existing Kls Desk client.

Each invited contact benefits from their own dedicated Debt Tracking view, which is synchronised with that of the manager. Confidential elements (such as commissions, sub-pools) remain hidden.

Managers can update transaction details throughout the lifespan of the financing.

Tab 2: Dataroom

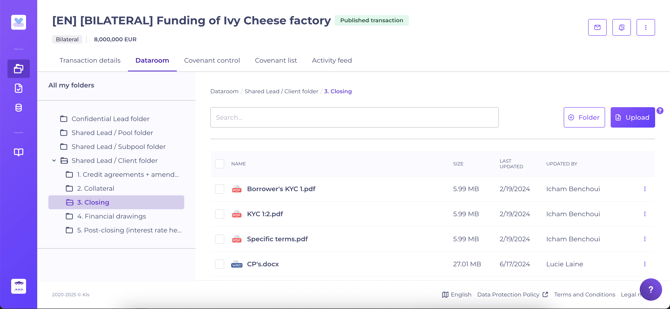

Each transaction features a secured and specific "Dataroom" tab.

Four distinct directories are provided, allowing managers to securely share confidential documentation internally, or with specific stakeholders.

Tab 3: Covenant list

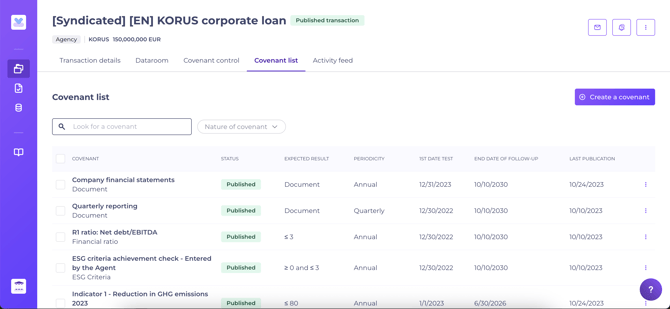

The Covenant List tab is visible to all operational stakeholder.

It serves two primary purposes:

- Centralising contract monitoring elements, such as covenants and ESG criteria.

The manager digitises these elements by creating a contractual framework for structured control. This promotes transparency and traceability, allowing stakeholders to view the covenants for which the customer is responsible. - Automating reminders for customers by pre-configuring control periods.

The manager may generate reminders for themselves, or, where appropriate, these may be dispatched to customers as well, reducing administrative burden.

Tab 4 - Covenant control

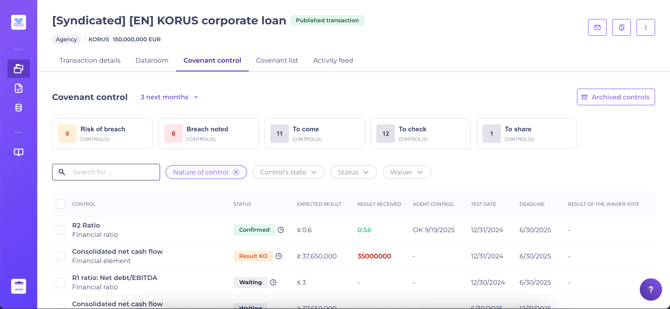

The Covenant Control tab provides a dashboard detailing the status of all control periods (current and upcoming), together with an archive of completed controls.

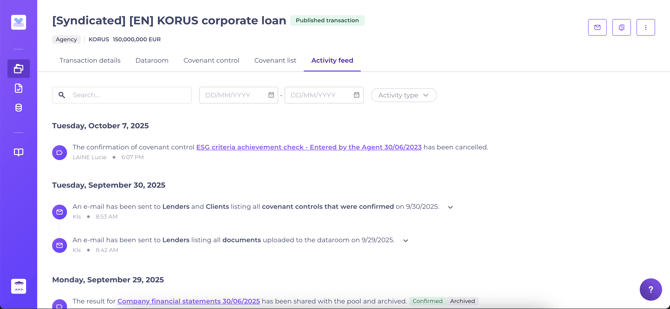

Tab 5 - Activity feed

This tab is designed to ensure full traceability of actions. Visible exclusively to the management team, it automatically logs all transaction-impacting events, and records notifications sent with a list of recipients.

Cross-functionality Features

1 - Control monitoring

The “Control monitoring” page acts as the manager's dashboard.

Here, all covenant controls published across the portfolio are summarised, enabling managers to easily see to easily identify overdue controls and prioritise actions. Advanced tagging and filtering tools support efficient search and review.

For more details, visit: How to use the Debt Tracking app Control Monitoring?

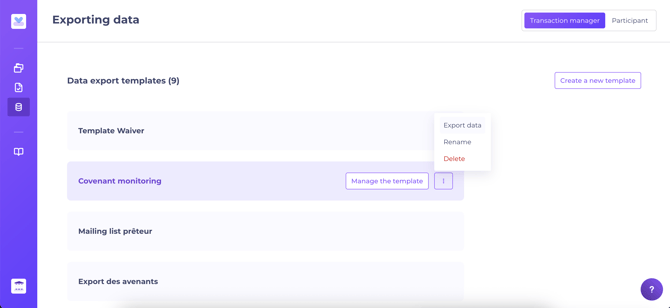

2 - Exporting data

The “Exporting data” functionality enables users to export transaction data from Debt Tracking as required.

Exports can support internal reporting, audits, or ongoing control processes, and facilitate the transfer of information from the Desk into other systems.